More information was released regarding the stimulus checks or economic impact payments that are expected to be distributed to help alleviate the financial impact of COVID-19.

The Internal Revenue Service reported that people who did not file a tax return in 2018 or 2019 can enter their information into the online portal Free File Fillable Forms accessed through the IRS website. In addition, if the person has a qualifying child that they need to claim, they can add that information to their application to ensure they receive a $500 payment per child.

If you receive benefits in the form of disability, Social Security, Railroad Retirement and Survivor Benefits, then there is no need to submit a non-filer application.

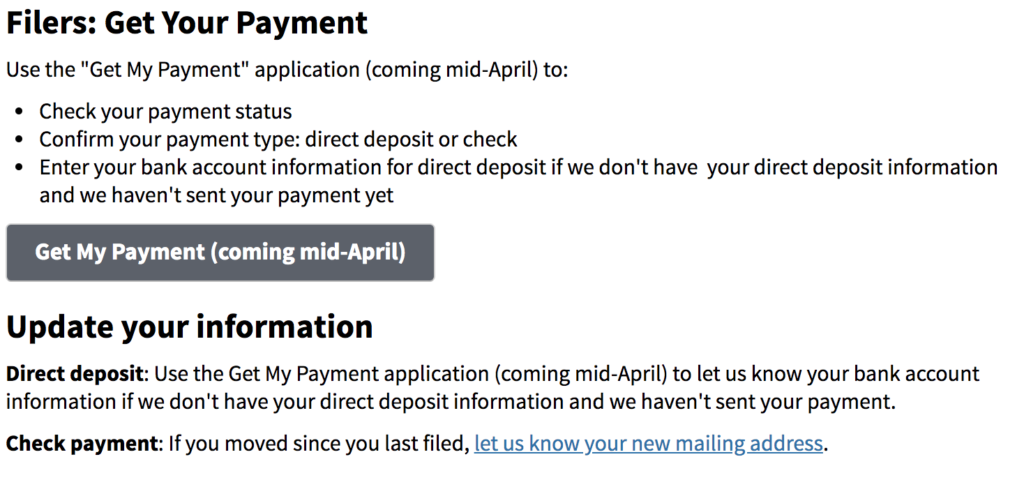

How To Check Payment Status For 2018/2019 Taxpayers

What Do You Need

Applicants will need to have available their personal information, such as mailing address, email, date of birth, social security number, bank account, routing number, driver’s license or state-issued ID and social security information regarding the child.

What Happens Next

The website states, “You will receive an e-mail from customer service at Free File Fillable Forms that either acknowledges you have successfully submitted your information, or that tells you there is a problem and how to correct it. Free File Fillable forms will use the information to automatically complete a Form 1040 and transmit it to the IRS to compute and send you a payment.”

How Much Are The Checks

Checks are expected to be disbursed in $1,200 (individual) or $2,400 (married) lump sums, plus an additional $500 per child. Again, if the taxpayer filed taxes in 2018 or 2019 no further action is needed.

Watch For Scams

The IRS warns people to be aware of COVID-19 scams and to never share any personal information over phone, text, email or social media.

“For security reasons, the IRS plans to mail a letter about the economic impact payment to the taxpayer’s last known address within 15 days after the payment is paid. The letter will provide information on how the payment was made and how to report any failure to receive the payment. If a taxpayer is unsure they’re receiving a legitimate letter, the IRS urges taxpayers to visit IRS.gov first to protect against scam artists.”