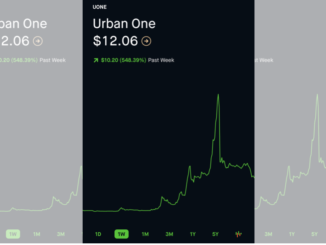

Tesla CEO Elon Musk has surpassed Mark Zuckerberg, the co-founder of social media website Facebook, as the third richest person in the United States.

Musk’s net worth stands at $111.3 billion, according to Bloomberg.com. Amazon.com’s Jeff Bezos and Microsoft’s Bill Gates hold the number one and two spots, respectively.

The latest development comes on the heels of Tesla, Inc. deciding to do a 5-for-1 stock split, which issues more shares to shareholders resulting in the increase of the number of shares that are outstanding. In other words, the shareholder receives an additional five shares for every one share held.

The goal of the stock split is to make the share price appear to be more affordable. The stock split lowered the stock price with it currently standing at $494 at the time of this writing. However, the price is sure to increase as investor demand increases.

Before the split, the electric car company had a stock price that soared beyond $1,000. Tesla has a valuation of $448 billion and has seen an increase in stock value of 474 percent in 2020, according to Yahoo!Finance.

Tesla is not the only one taking advantage of stock splits. Steve Job’s Apple shares implemented a 4-for-1 stock split on the same day. Apple stands at a 4.53 percent change and a stock price of $130.